- Atlanta, GA

Menu

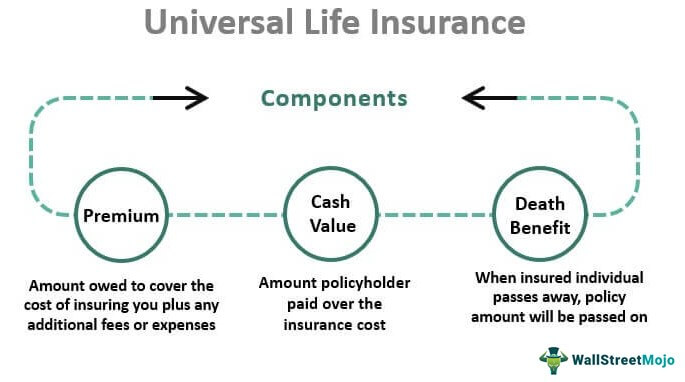

The best parts about Universal Life Insurance are its flexibility in premium payments and the ability to accumulate a cash value that grows tax-deferred, which can be accessed for loans or withdrawals. Additionally, it provides lifelong coverage with an adjustable death benefit offering both insurance protection and a savings component.

Universal life insurance is a type of permanent life insurance, which means it offers lengthy coverage and builds cash value over time. Policies typically last until a certain age, such as 95 or 120. This coverage offers flexibility that other permanent policies — like whole life insurance — don’t. For example, you can adjust the amount you pay in premiums, which may appeal to those with fluctuating incomes.

Universal life policies work in a similar way to other permanent policies. In exchange for premiums, you typically get lifelong coverage, and your beneficiaries receive a payout when you die. You also have the opportunity to build cash value and take out loans while you’re still alive. However, universal life insurance has unique features that set it apart from other types of policies.

Universal life policies work in a similar way to other permanent policies. In exchange for premiums, you typically get lifelong coverage, and your beneficiaries receive a payout when you die. You also have the opportunity to build cash value and take out loans while you’re still alive.

However, universal life insurance has unique features that set it apart from other types of policies.

Universal policies allow you to change the size and frequency of your payments which can be handy when times are lean; however, paying less can put you at risk of a policy lapse, so check with a fee-based life insurance advisor before making significant changes to your premium payments.

Your policy may include the option to increase the death benefit if you need more, although you’ll likely need to take a life insurance medical exam to qualify for the extra coverage. If you want to decrease your death benefit, you can typically do so after the policy has been enforce for a few years.

The money in your cash value account will earn interest at the rate set by your insurer, and the rate can change frequently.

Get started before it’s too late! It’s a limited time offer so hurry up! Get your 10% discount today!

Simple to fully underwritten policies with all the extras that we can show you